Investing for Beginners: A Step-by-Step Guide with Helpful Books

Table of Contents

Investing is a way of putting your money to work for you, so that you can achieve your financial goals and grow your wealth over time. However, investing can also be intimidating and confusing for beginners, especially with so many options and strategies available.

That’s why we have created this guide to help you get started with investing, even if you have little or no experience. We will cover the following steps:

- Define your investing goals and time horizon

- Choose an investment account and platform

- Learn the basics of investing and risk management

- Pick an investment strategy and portfolio

- Review and adjust your investments regularly

We will also recommend some helpful books that you can read to learn more about investing and improve your skills. These books are available on Amazon, and we may earn a commission if you buy them through our links.

Step 1: Define your investing goals and time horizon

The first step to investing is to define your goals and time horizon. What are you investing for? How much money do you need to achieve your goals? How long can you invest your money for?

Your goals and time horizon will determine how much risk you can take, how much return you need, and what kind of investments are suitable for you. For example, if you are saving for retirement, you may have a long-term horizon and a moderate risk tolerance. If you are saving for a down payment on a house, you may have a short-term horizon and a low risk tolerance.

Some common investing goals are:

- Retirement

- Education

- Home purchase

- Travel

- Emergency fund

- Wealth creation

To define your goals and time horizon, you can use the SMART criteria:

- Specific: Be clear and precise about what you want to achieve and why.

- Measurable: Quantify your goals in terms of money and time.

- Achievable: Make sure your goals are realistic and attainable.

- Relevant: Align your goals with your values and priorities.

- Time-bound: Set a deadline or a target date for your goals.

For example, a SMART goal could be: “I want to save $50,000 for a down payment on a house in 5 years.”

Step 2: Choose an investment account and platform

The next step to investing is to choose an investment account and platform. An investment account is where you keep your money and assets that you invest. An investment platform is where you buy and sell your investments.

There are different types of investment accounts and platforms, each with its own features, benefits, and costs. Some of the factors to consider when choosing an account and platform are:

- Fees and commissions: How much do you have to pay to open, maintain, and use your account and platform?

- Tax advantages: Does your account offer any tax benefits or incentives for investing?

- Investment options: What kinds of investments can you buy and sell on your platform?

- Ease of use: How user-friendly and convenient is your platform?

- Customer service: How responsive and helpful is your platform’s support team?

Some of the common types of investment accounts and platforms are:

- Brokerage account: A brokerage account is a general-purpose account that allows you to buy and sell a wide range of investments, such as stocks, bonds, mutual funds, ETFs, and more. You can open a brokerage account with an online broker, such as E*TRADE, Fidelity, or Schwab. Brokerage accounts typically charge fees and commissions for each trade, and the income and gains from your investments are subject to tax.

- Retirement account: A retirement account is a special type of account that is designed to help you save for retirement. There are two main types of retirement accounts: individual retirement accounts (IRAs) and employer-sponsored plans (such as 401(k)s). Retirement accounts offer tax advantages, such as tax-deferred or tax-free growth, but they also have rules and limits on how much you can contribute and when you can withdraw your money. You can open an IRA with an online broker, or enroll in an employer-sponsored plan through your work.

- Robo-advisor: A robo-advisor is a service that uses algorithms and technology to manage your investments for you. You simply answer some questions about your goals, risk tolerance, and preferences, and the robo-advisor will create and maintain a diversified portfolio for you. You can access a robo-advisor through an online platform, such as Betterment, Wealthfront, or Ellevest. Robo-advisors typically charge a low annual fee based on a percentage of your assets, and they may use brokerage or retirement accounts to hold your investments.

Step 3: Learn the basics of investing and risk management

The third step to investing is to learn the basics of investing and risk management. Investing is not a gamble or a get-rich-quick scheme. It is a process of allocating your money to different assets that have the potential to generate income or appreciate in value over time. However, investing also involves risk, which is the possibility of losing some or all of your money.

To be a successful investor, you need to understand the fundamental concepts and principles of investing and risk management, such as:

- Asset classes: Asset classes are broad categories of investments that have similar characteristics and behaviors. The main asset classes are stocks, bonds, cash, and alternatives (such as real estate, commodities, and cryptocurrencies).

- Risk-return trade-off: Risk-return trade-off is the relationship between the risk and the expected return of an investment. Generally, the higher the risk, the higher the potential return, and vice versa. For example, stocks are riskier than bonds, but they also offer higher returns in the long run.

- Diversification: Diversification is the practice of spreading your money across different asset classes, sectors, industries, countries, and companies. Diversification helps reduce your overall risk, because not all investments move in the same direction at the same time. For example, if one of your stocks drops in value, another one may rise, or your bonds may cushion the loss.

- Asset allocation: Asset allocation is the process of deciding how much of your money to invest in each asset class, based on your goals, time horizon, and risk tolerance. Asset allocation is one of the most important factors that determine your long-term investment performance. For example, if you are saving for retirement, you may want to have a higher allocation to stocks when you are young, and gradually shift to more bonds and cash as you approach retirement.

- Rebalancing: Rebalancing is the process of adjusting your portfolio periodically to maintain your desired asset allocation and risk level. Rebalancing helps you avoid drifting too far from your original plan, and take advantage of market fluctuations. For example, if your portfolio has grown too much in stocks, you may want to sell some stocks and buy more bonds to restore your balance.

To learn more about these topics, you can read some of the best books on investing, such as:

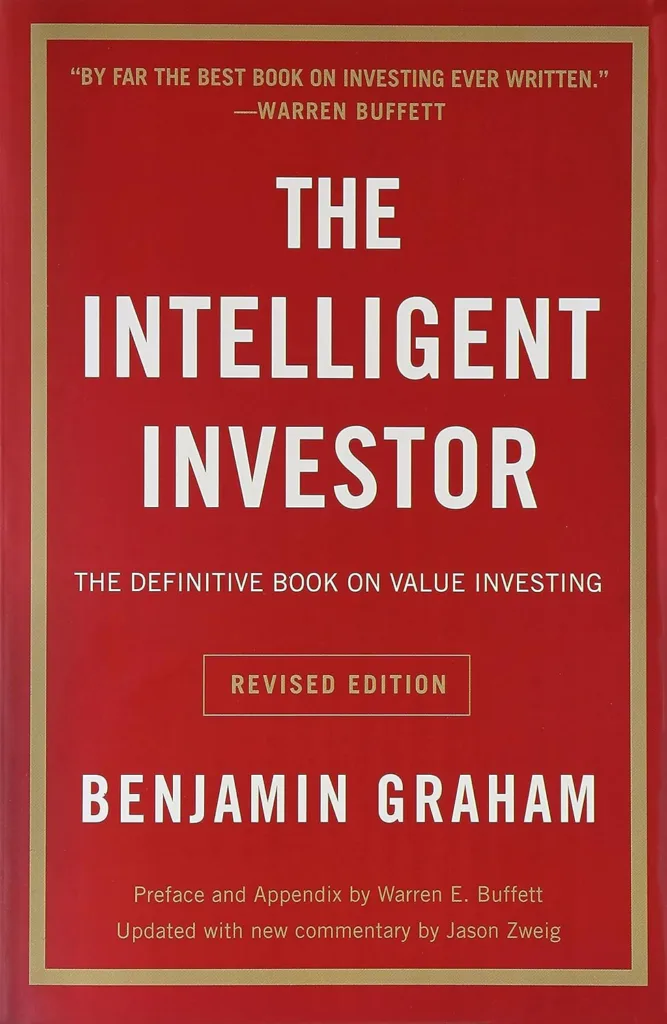

- The Intelligent Investor by Benjamin Graham: This is the classic book on value investing, which is the strategy of buying undervalued stocks and holding them for the long term. Graham teaches you how to analyze stocks, avoid emotional mistakes, and achieve consistent returns. This book is recommended by many of the world’s most successful investors, including Warren Buffett, who calls it “by far the best book on investing ever written.”

- The Little Book of Common Sense Investing by John C. Bogle: This is the definitive book on index investing, which is the strategy of buying low-cost funds that track the performance of the entire market or a specific segment. Bogle, the founder of Vanguard and the creator of the first index fund, shows you how to beat the majority of active investors by simply capturing the market return with minimal fees and taxes. This book is praised by many of the world’s leading financial experts, including Burton Malkiel, David Swensen, and Paul Samuelson.

- The Psychology of Money by Morgan Housel: This is a fascinating book on the behavioral aspects of investing, which are often overlooked or ignored by traditional finance theory. Housel, a former columnist for The Motley Fool and The Wall Street Journal, explores how our emotions, biases, and experiences shape our decisions and outcomes. This book is filled with insightful stories and practical lessons that will help you improve your financial habits and mindset.

Step 4: Pick an investment strategy and portfolio

The fourth step to investing is to pick an investment strategy and portfolio. An investment strategy is a set of rules or guidelines that you follow to select, buy, and sell your investments. An investment portfolio is a collection of investments that you own and manage according to your strategy.

There are many different investment strategies and portfolios, each with its own advantages and disadvantages. Some of the factors to consider when choosing a strategy and portfolio are:

- Performance: How well has the strategy and portfolio performed in the past and present, in terms of return, risk, and consistency?

- Suitability: How well does the strategy and portfolio match your goals, time horizon, and risk tolerance?

- Simplicity: How easy is it to understand and implement the strategy and portfolio, and how much time and effort does it require?

- Cost: How much do you have to pay for the strategy and portfolio, in terms of fees, commissions, taxes, and expenses?

Some of the common investment strategies and portfolios are:

- Value investing: Value investing is the strategy of buying stocks that are trading below their intrinsic value, based on fundamental analysis. Value investors look for companies that have

Read Also:

Mastering Negotiation Skills: Top 5 Books For Success

Disclaimer: As an Amazon Affiliate, We may earn commissions on purchase through the links in this post to support the functioning of this website.